Procedural Updates

DSLI Bill Passes Senate

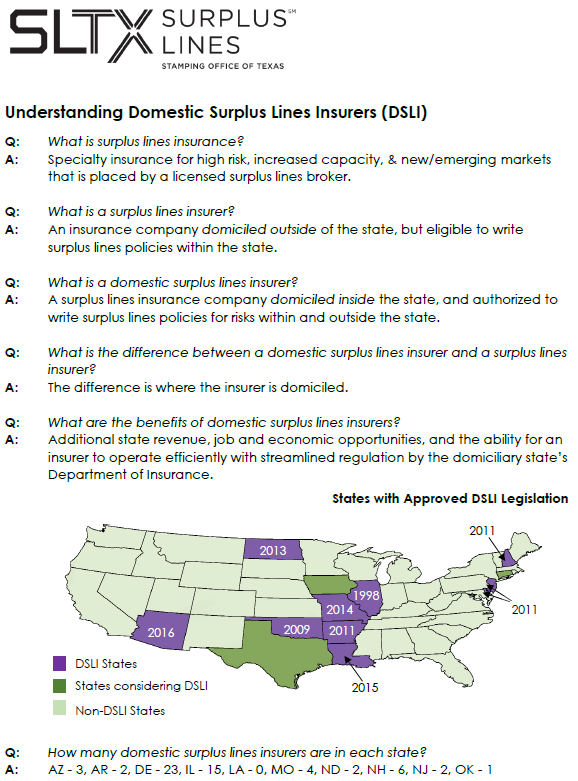

A bill that will introduce a new designation for insurers has been passed by the Texas Senate. Senate Bill 1491, sponsored by Sen. Judith Zaffirini, would allow surplus lines insurers to be domiciled in the state of Texas. Currently, surplus lines insurers must be domiciled outside the state to write surplus lines coverage.

The Senate voted 30-1 in favor of the bill on Thursday, April 27, 2017. The Senate Business and Commerce Committee passed the bill on Wednesday, April 19, 2017, with a vote of 8-1.

The House of Representatives companion to the bill, House Bill 2492, sponsored by Rep. John Frullo, has made it out of the House Insurance Committee, but has not yet been voted on by the House.

NFIP Reforms Have Support from Both Sides of Aisle

A recent survey shows that proposed reforms of the National Flood Insurance Program (NFIP) has bipartisan support.

According to Business Insurance, the survey, conducted by Public Opinion Strategies and the Pew Charitable Trusts, consisted of 1,000 respondents, and revealed that 74 percent supported three or more proposed reforms to the program. However, 82 percent could not say whether NFIP was in a deficit or surplus, even though the program has a debt of $24.6 billion.

The proposed reforms include the following:

- A plan that would require infrastructure in flood-prone areas to better withstand the impact of flooding

- Conservation buyouts, which means that homeowners could be compensated at pre-flood rates for their property so they can move to a safer location, if they so choose

- Requiring communities that have more than 50 homes that have been classified as having repeatedly flooded to invest in the future risk of flood

The survey proves that support and agreement over an NFIP overhaul exists regardless of region. Results were positive across the country, with a majority of respondents in favor of reform and proposed improvements to prevent future damage.

Understanding Domestic Surplus Lines Insurers (DSLI)

Housing and Insurance Subcommittee to Hold Hearing on NFIP

Jeb Hensarling (R-TX), Chairman of the US House of Representatives Financial Services Committee, has announced that the Housing and Insurance Subcommittee will hold a hearing titled, “Flood Insurance Reform: A Community Perspective.”

The subcommittee will discuss the National Flood Insurance Program (NFIP) from a community level, and it will examine any needed reforms that would increase transparency in claims and payments. The subcommittee will also discuss how a private flood insurance market could compliment or exceed the current NFIP plan.

The hearing will be held on Thursday, March 16, at 2:00 p.m. local time in Washington D.C.

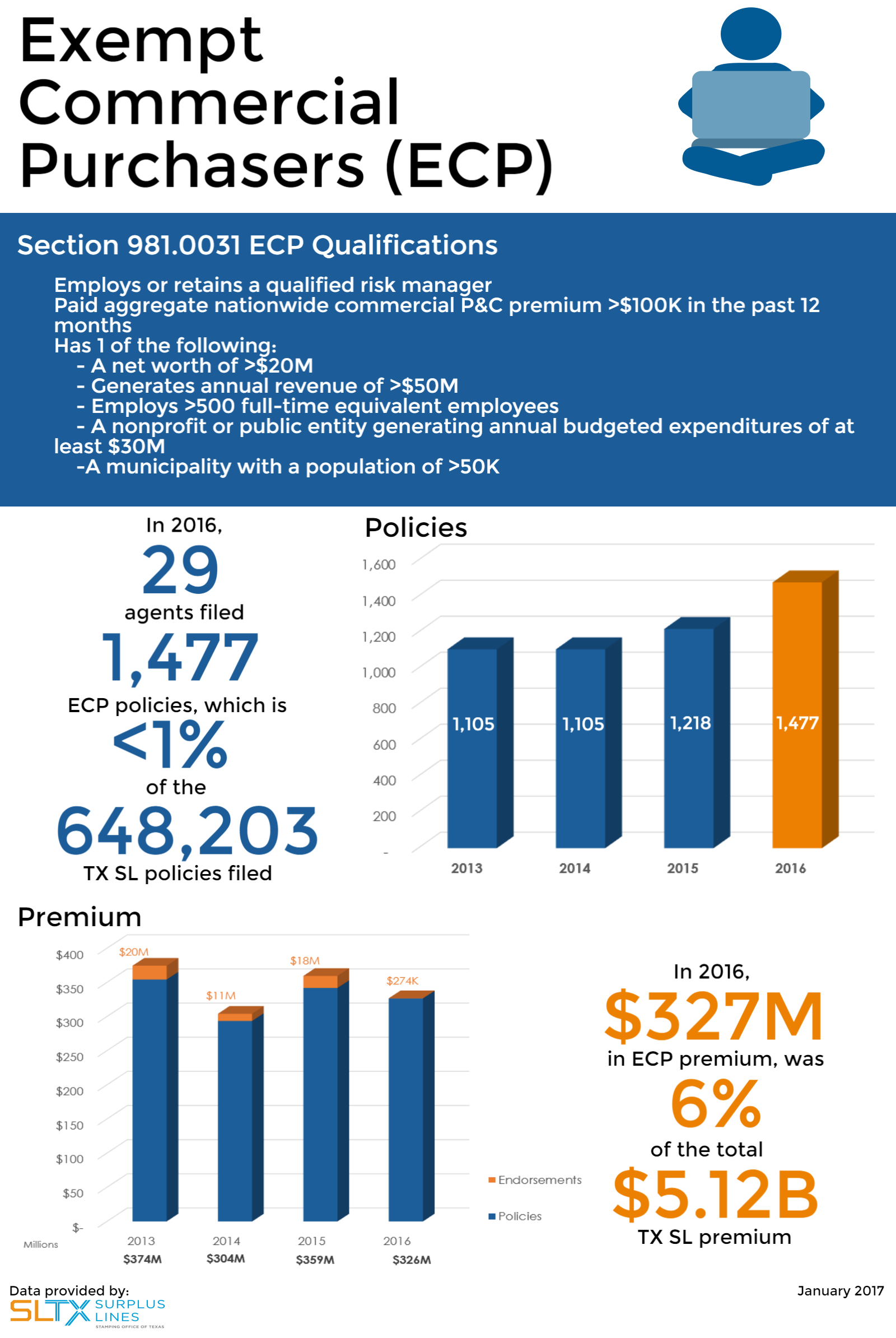

Exempt Commercial Purchasers (ECP)

Lone Star Lines – Volume 21, October – December

Lone Star Lines – Volume 21, July – September

Notice of Proposed Stamping Fee Increase

The Board of Directors of the Surplus Lines Stamping Office of Texas approved a resolution in June 2015 requesting that the Commissioner of Insurance authorize an increase in the stamping fee rate up to 0.15% (0.0015) from its current rate of 0.06% (0.0006), as required under the Plan of Operation. The Plan of Operation can be referenced in 28 TAC §15.101.

As of this date, the formal request is before the Commissioner and under consideration. Commentary period will be through August 20, 2015.

The proposed effective date for the increase to 0.15% will be January 1, 2016.