Procedural Updates

Commissioner of Insurance to Overlook Recommendation to Reduce Stamping Fee for SLTX

The Texas Department of Insurance has provided a notice of recommendation by the Surplus Lines Stamping Office of Texas Board of Directors regarding a decrease in the stamping fee from the current rate of 0.15% of gross premium to 0.075%. Surplus lines agents provide stamping fee payments to the stamping office which in return funds operations within the organization. The final decision will belong to the Commissioner of Insurance to approve any changes made to the stamping fee.

TDI will be accepting public comments regarding the stamping fee decrease as well as the date for which the decrease will go into effect.

A copy of the recommendation and associated documents can be found here.

The Texas Department of Insurance will also accept written comments regarding the decrease of the stamping fee, but they must be submitted before 5 PM, Central Time, on August 27, 2020. Comments can be sent via mail (Office of the Chief Clerk, MC 112-2A, Texas Department of Insurance, P.O. Box 149104, Austin, Texas 78714-9104) or email (ChiefClerk@tdi.texas.gov)

Updated Plan of Operation Posted on SLTX Website

On July 3, 2020, the Texas Commissioner of Insurance released an official order regarding Plan of Operation amendments for the Surplus Lines Stamping Office of Texas.

The updated Plan of Operation can now be viewed on the SLTX website. Additionally, the prior Plan of Operation is also available on the same webpage.

For more information on the background and timeline in addition to the Plan of Operation, please visit Order No. 2020-6384 on the Texas Department of Insurance website.

Texas Commissioner of Insurance Adopts SLTX Plan of Operation

On July 3, 2020, the Texas Commissioner of Insurance released an official order regarding Plan of Operation amendments for the Surplus Lines Stamping Office of Texas.

Prior to the announcement, the Texas Department of Insurance held a public hearing on June 17, 2020 to consider amendments for the SLTX Plan of Operation. Due to COVID-19, the hearing was held via teleconference. The archived meeting can be found here.

Order No. 2020-6384 provides a background and timeline in addition to the adopted Plan of Operation. For further information, please visit the Texas Department of Insurance website.

FEMA Releases Guidance Packet in Wake of 2020 Hurricane Season

As hurricane season approaches, the Federal Emergency Management Agency (FEMA) has announced the release of their “COVID-19 Pandemic Operational Guidance for the 2020 Hurricane Season.” This guide will allow emergency managers and public health officials to stay prepared in the event of a natural disaster, while continuing to stay alert and responsive during the coronavirus (COVID-19) pandemic. The packet can also benefit private sectors and non-government organizations to better understand the government’s efforts to stay prepared.

Compared to previous years, FEMA’s program delivery will be different this year due to the pandemic. However, there should not be any major changes regarding program eligibility, time frame for grant awards, or amount of assistance to be provided under the “Individual and Households Program.” Although the focus of the guidance packet is for hurricane season, it may still be useful throughout the COVID-19 pandemic without any notice of storm systems.

FEMA further states they will continue to operate through their locally executed, state managed, and federal incident response system. This will allow for better collaboration between FEMA and state, local, tribal, and territorial partners before hurricane season begins. With this shared understanding, disaster response and recovery efforts will be better executed and received by the nation.

For more information on FEMA’s 2020 pandemic operational guide during the hurricane season, please visit FEMA’s website.

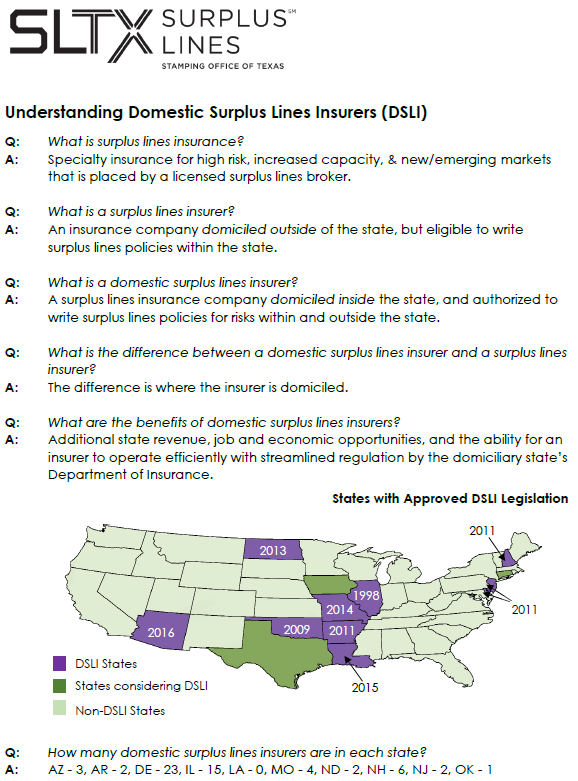

Gov. Abbott Signs DSLI Bill

House Bill 2492, which authorizes domestic surplus lines insurers (DSLI) in Texas, was signed into law by Texas Governor Greg Abbott on Thursday, June 15, 2017.

The bill, effective January 1, 2018, will allow surplus lines insurers domiciled in other states to apply for a DSLI certificate from the Texas Department of Insurance (TDI). If approved, the insurer will be designated as a DSLI, which means that it may be domiciled in Texas and write surplus lines policies in Texas. Before the law was introduced, eligible surplus lines insurers were required to be domiciled outside of Texas to write business in the state.

The passage of the law may increase jobs and revenue in Texas, as well as improve regulatory oversight by TDI. New procedures and policies for DSLIs may also be introduced as the law takes effect.

DSLI Bill Passes Senate

A bill that will introduce a new designation for insurers has been passed by the Texas Senate. Senate Bill 1491, sponsored by Sen. Judith Zaffirini, would allow surplus lines insurers to be domiciled in the state of Texas. Currently, surplus lines insurers must be domiciled outside the state to write surplus lines coverage.

The Senate voted 30-1 in favor of the bill on Thursday, April 27, 2017. The Senate Business and Commerce Committee passed the bill on Wednesday, April 19, 2017, with a vote of 8-1.

The House of Representatives companion to the bill, House Bill 2492, sponsored by Rep. John Frullo, has made it out of the House Insurance Committee, but has not yet been voted on by the House.

NFIP Reforms Have Support from Both Sides of Aisle

A recent survey shows that proposed reforms of the National Flood Insurance Program (NFIP) has bipartisan support.

According to Business Insurance, the survey, conducted by Public Opinion Strategies and the Pew Charitable Trusts, consisted of 1,000 respondents, and revealed that 74 percent supported three or more proposed reforms to the program. However, 82 percent could not say whether NFIP was in a deficit or surplus, even though the program has a debt of $24.6 billion.

The proposed reforms include the following:

- A plan that would require infrastructure in flood-prone areas to better withstand the impact of flooding

- Conservation buyouts, which means that homeowners could be compensated at pre-flood rates for their property so they can move to a safer location, if they so choose

- Requiring communities that have more than 50 homes that have been classified as having repeatedly flooded to invest in the future risk of flood

The survey proves that support and agreement over an NFIP overhaul exists regardless of region. Results were positive across the country, with a majority of respondents in favor of reform and proposed improvements to prevent future damage.

Understanding Domestic Surplus Lines Insurers (DSLI)

Housing and Insurance Subcommittee to Hold Hearing on NFIP

Jeb Hensarling (R-TX), Chairman of the US House of Representatives Financial Services Committee, has announced that the Housing and Insurance Subcommittee will hold a hearing titled, “Flood Insurance Reform: A Community Perspective.”

The subcommittee will discuss the National Flood Insurance Program (NFIP) from a community level, and it will examine any needed reforms that would increase transparency in claims and payments. The subcommittee will also discuss how a private flood insurance market could compliment or exceed the current NFIP plan.

The hearing will be held on Thursday, March 16, at 2:00 p.m. local time in Washington D.C.