Texas E&S Flood Policies Decrease in Coastal Counties Following Harvey 1

In the months after Hurricane Harvey hit the coast of Texas, the amount of excess and surplus lines (E&S) flood policies in the 60 coastal counties impacted by the hurricane filed with SLTX declined, though the number of flood policies in the rest of the state increased.

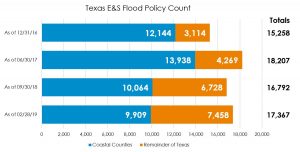

In evaluating policies in force as of June 30, 2017, SLTX found that 76.6% of flood policies were located in the 60 impacted coastal counties included in an ongoing Harvey disaster declaration, with 13,938 of 18,207 total policies filed. About a year after Harvey, for policies in force as of September 30, 2018, 59.9% of flood policies recorded were written in the affected counties, at 10,064 of 16,792 total. However, while the number of flood policies in the counties included in the disaster declaration decreased between these two dates, the number of flood policies written in the remainder of the state increased over the same time. As of June 30, 2017, 4,269 flood policies were in force for all other counties in Texas, and, as of September 30, 2018, that number increased to 6,728, with a further increase to 9,909 as of February 28, 2019.

In evaluating policies in force as of June 30, 2017, SLTX found that 76.6% of flood policies were located in the 60 impacted coastal counties included in an ongoing Harvey disaster declaration, with 13,938 of 18,207 total policies filed. About a year after Harvey, for policies in force as of September 30, 2018, 59.9% of flood policies recorded were written in the affected counties, at 10,064 of 16,792 total. However, while the number of flood policies in the counties included in the disaster declaration decreased between these two dates, the number of flood policies written in the remainder of the state increased over the same time. As of June 30, 2017, 4,269 flood policies were in force for all other counties in Texas, and, as of September 30, 2018, that number increased to 6,728, with a further increase to 9,909 as of February 28, 2019.

Counties outside of the disaster declaration experienced increases in both new and renewal policies at points in 2016 through 2019, while counties affected by Harvey saw a decrease in the amount of renewal policies in 2018. The amount of new policies in these 60 counties declined over this period, which may indicate that more consumers turned to the National Flood Insurance Program (NFIP) to purchase coverage on the coast.

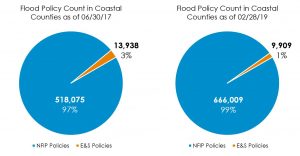

Information compiled by the Texas Department of Insurance (TDI) shows that the number of NFIP policies in the coastal counties impacted by Hurricane Harvey increased by 29% when comparing policies in force on June 30, 2017, and those in force as of September 30, 2018, from 518,075 to 669,355. More than a year after Harvey, as of February 28, 2019, NFIP policy count decreased in these counties to 666,009.

Information compiled by the Texas Department of Insurance (TDI) shows that the number of NFIP policies in the coastal counties impacted by Hurricane Harvey increased by 29% when comparing policies in force on June 30, 2017, and those in force as of September 30, 2018, from 518,075 to 669,355. More than a year after Harvey, as of February 28, 2019, NFIP policy count decreased in these counties to 666,009.

In an editorial published prior to the beginning of the 2019 hurricane season, Texas Insurance Commissioner Kent Sullivan urged consumers to remember historical trends, where flood insurance policies spike following a major catastrophe but decline in the months that follow. With the passage of HB 1306, a bill that creates a diligent effort exception for surplus lines flood policies, it’s possible that Texas will see an increase in private flood insurance policies. As the bill takes effect, SLTX will monitor its impact on the industry and the flood insurance market.