Bart Koch Appointed to SLTX Board of Directors

The Surplus Lines Stamping Office of Texas (SLTX) captures insurance data from service offices across the United States. The data includes information on premium and filing totals from 14 offices across the country, which depict the landscape of the excess and surplus lines marketplace across four primary U.S. regions.

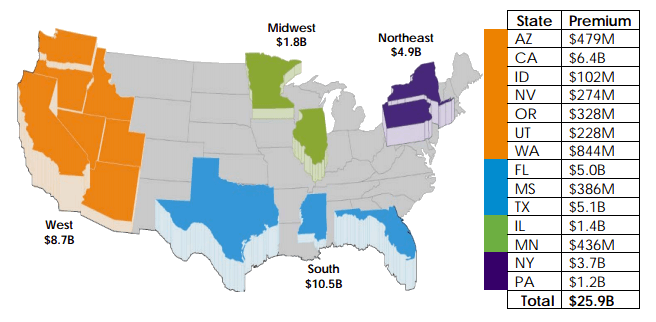

Overall, 2016 ended on a positive note for the excess and surplus lines insurance industry. Nationally, nearly $26 billion in surplus lines insurance premium was recorded for end-of-year 2016, which is a 3.27% rise from 2015. In addition, the amount of filings recorded in 2016 represents a 3.1% increase from that of 2015, with about 3.6 million filings in total.

The southern region, which includes Florida, Mississippi, and Texas, accounted for the highest amount of surplus lines insurance premium, at approximately $10.5 billion. This same region also recorded the most filings, with more than 2 million. Mississippi had the largest increase in filings overall, with an 11.28% rise from 117,000 filings in 2015 to 130,000 total filings in 2016.

Three (3) of the largest surplus lines markets (California, Texas, and Florida) all reported increases in premium for 2016, even after mid-year data showed decreases in premium over the first six months of the year. Premium in California increased by 4.6%, Florida had a gain of 0.55%, and Texas premium increased by 2.06%. Texas and Florida showed similar growth in filings, with 5.08% and 5.88%, respectively, while California reported a decrease in the amount of filings for 2016 by 8.92%.

New York, the fourth largest market with $3.7 billion in total 2016 premium, recorded a 1.98% increase in premium and a 6.12% increase in filings. Pennsylvania and Illinois also recorded more than $1 billion in premium.

Eight (8) other states brought in less than $1 billion in premium, with seven (7) of them accounting for less than $500 million each. Of these states, Washington enjoyed a 10.64% year over year increase in total premium with a rise from $762.9 million in 2015 to $844.1 million in 2016. In addition, filings in Washington grew 7.17% in 2016 to approximately 112,000. Bob Hope, Executive Director of the Surplus Line Association of Washington, stated that his state saw an increase of about $20 million in property premiums, mostly in difference-in-conditions insurance and standalone flood and earthquake areas. Hope said casualty premiums were also up by almost $60 million, with the largest increases found in errors and omissions, directors and officers, construction, and cyber liability policies.

Overall, Pennsylvania reported the highest increase in premium with 30.53%, at $1.2 billion in 2016 premium. In addition to recorded premium numbers, Pennsylvania also finalized a $3.08 billion enforcement action involving 1,172 additional policies in early 2016. The second largest increase was recorded in Idaho, which experienced a 13.53% growth to $102 million in total premium.

Over the course of 2016, 4 states’ stamping fees/assessment rates were changed as follows:

- Idaho’s rate from .25% to .50%, effective January 1, 2016.

- Texas’ rate from .06% to .15%, effective January 1, 2016.

- Florida’s rate from .175% to .15%, effective April 1, 2016.

- Minnesota’s rate from .06% to .04%, effective October 1, 2016

Of the states that implemented new stamping fees, Minnesota was the only to experience a decrease in premium, at 12.1% less than 2015. “Even with slight changes reported by all the peer offices,” stated Norma Carabajal Essary, SLTX Executive Director, “the overall message points to a healthy excess and surplus lines industry that continues to maintain a strong presence across the U.S.”