SLTX E&S Market Report

The following market report of the surplus lines industry in Texas is an analysis using data from AM Best and SLTX. All data obtained from AM Best originates from 2020 NAIC Annual Financial Statements and supplementary documents filed for all active P&C writers. As such, all AM Best data represented is applicable for companies domiciled in the US only.

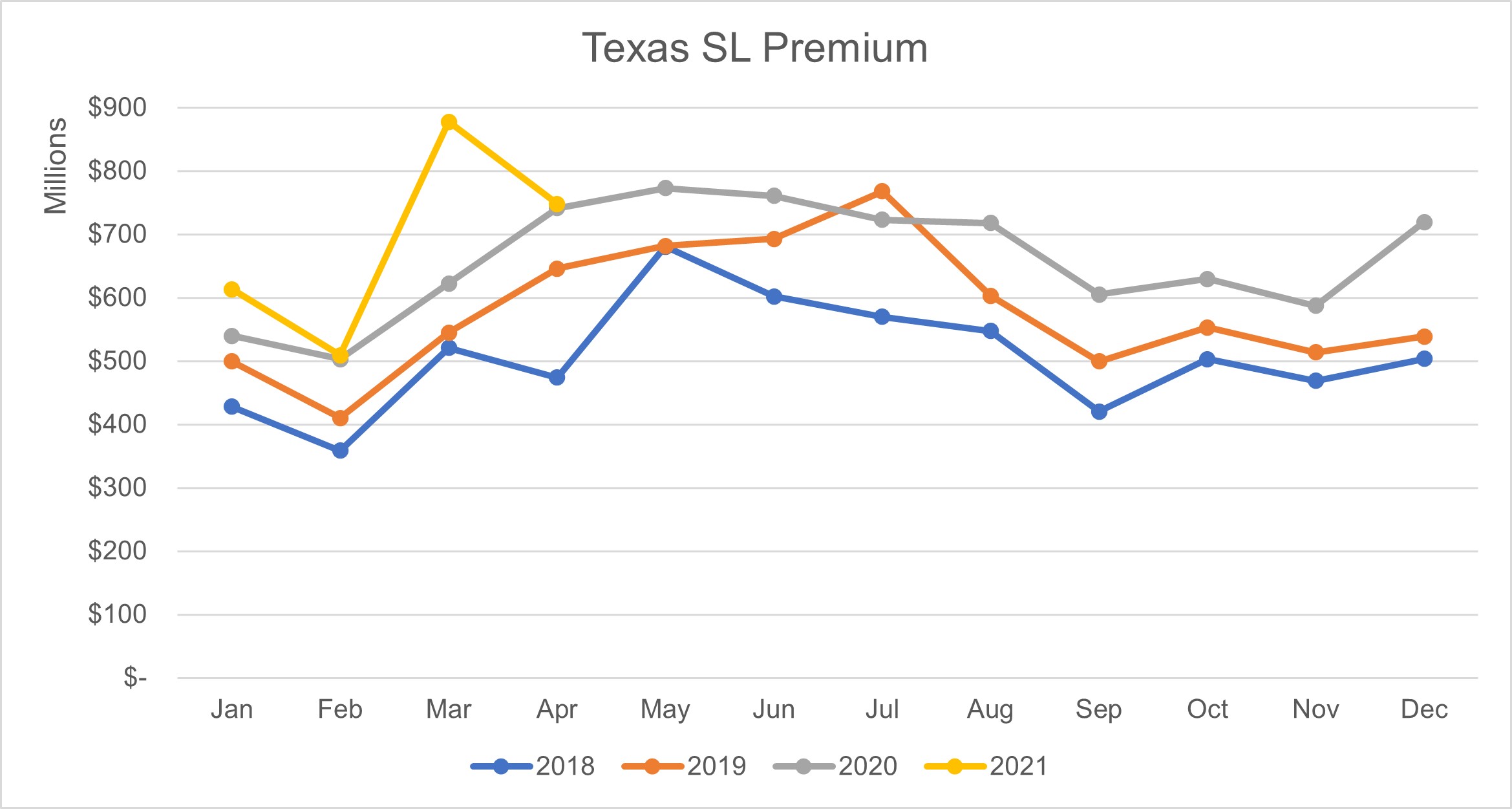

Over the past few years, historic premium increases in the Texas E&S market have been well-documented. SLTX reported the highest premium for every month in 2021 thus far. Simultaneously, SLTX has seen policy counts increase at a much slower rate, indicating the amount of premium per policies have driven the premium increase.

This chart breaks down the premium reported to SLTX by month and year from 2018 through April 2021. All data collected is Texas premium as reported to SLTX during the given period.

In June 2019, SLTX documented how the market trends at a time which indicated a hardening E&S market nationwide was on the horizon. In the successive two years, market data validated previous premonitions. In 2020, the Texas E&S market was marked by increasing premiums and conservative underwriting.

While 2019 E&S submissions to SLTX increased with premium, this volume coincided with a nationwide decrease in E&S submissions in 2020. Therefore, the current E&S market growth on a premium basis may not necessarily be due to lower risk appetites in the admitted market, as was the case in 2019.

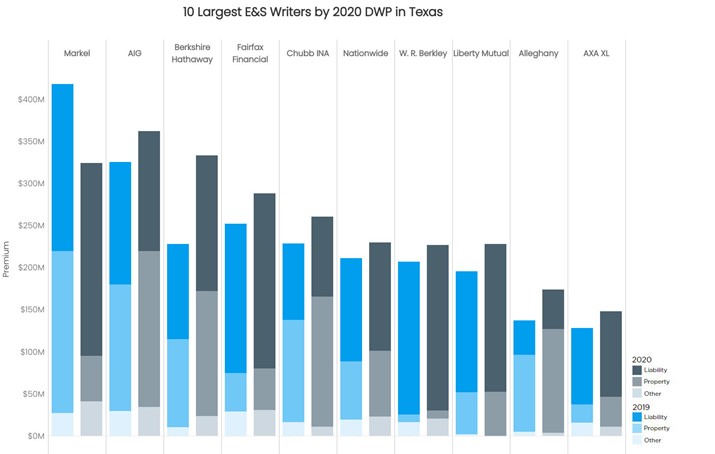

In 2020, the majority of the 10 largest writers of E&S premium in Texas increased their direct written premium (DWP) by 10.5% on average over 2019. Berkshire Hathaway Insurance Group experienced the largest increase at 46.3%, followed by Alleghany Corporation Group at 27.0% and Liberty Mutual Insurance Group at 16.6%.

This chart breaks down the largest surplus lines writers by group in Texas, where the group has at least one (1) E&S writer. All data was collected from A.M. Best as reflected on the companies’ Exhibit of Premium and Losses form and only represents companies domiciled in the US.

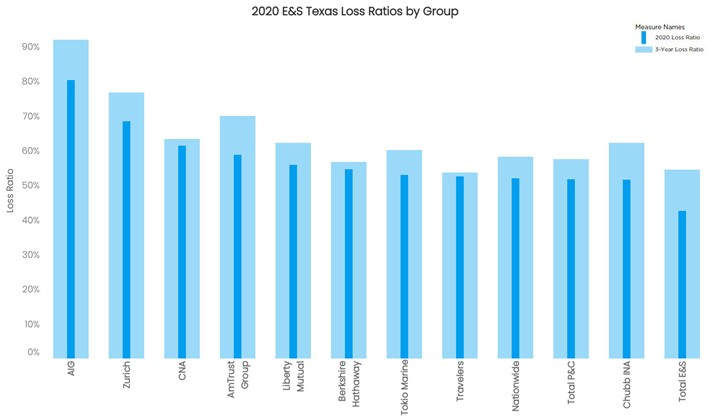

Liability coverages accounted for the largest increase; with a 13.9% greater than in 2019 for the aforementioned groups. A combination of stricter underwriting standards and an increased concentration in long-tailed lines of business may explain vastly improved underwriting performances for E&S carriers in 2020. More specifically, the top 10 E&S groups in Texas, as well as the entire E&S industry, experienced a more favorable loss ratio in 2020 than in recent years.

This chart provides the 2020 Loss Ratio in Texas and the 3-year Loss Ratio by Group for the top 15 premium writers in Texas. This information was collected from A. M. Best loss information, as reflected on companies’ Schedule T form, and only represents companies domiciled in the US.

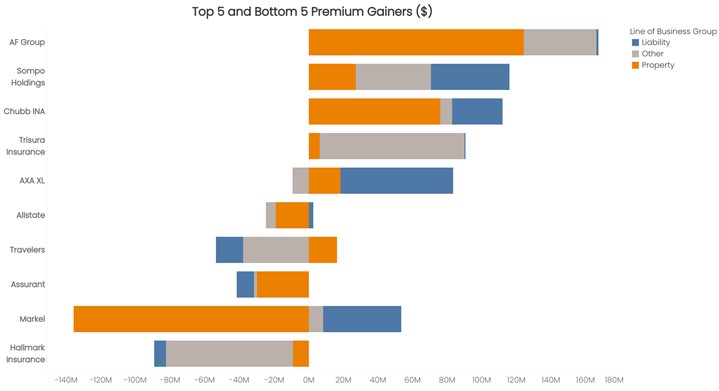

While the entire E&S industry experienced a larger increase in liability coverages than property, SLTX noted that the trend is not necessarily applicable to all individual groups. Of the five groups with an E&S carrier actively writing in Texas which accounted for the largest premium increases, three saw the largest increases in property coverages. On the other hand, three of the five groups which accounted for the largest premium decreases saw the largest decreases in property coverages.

This chart shows the groups with the greatest increase or decrease in Texas premium from 2019 to 2020, broken down by coverage category. All data was collected from A.M. Best as reflected on the companies’ Exhibit of Premium and Losses form and only represents companies domiciled in the US.

As the complexity of risks grows, the surplus lines industry will continue to be a haven for business that does not fit the risk appetite for admitted carriers. Even as the COVID-19 pandemic impacted the entire insurance industry, the E&S market sustained a positive underwriting performance in 2019. Conversely, the full impact of COVID-19 on the E&S industry is still uncertain. It is anticipated that premium growth will remain a trend for the remainder of 2021, as such, SLTX will continue to monitor the Texas surplus lines industry and report any changes.